You’re a citizen, an advocate for democracy with this first step, paying attention.

Citizen Tip = California City Finance Primer

All of the information in this week’s Dues-day post are excerpts and charts from this finance primer report by League of California Cities. For some it may be too elementary, but invaluable to those of us new to city government finances. This isn’t about budget, it’s about revenue. This is important because the demand for unsustainable growth is in part generated by this current financial structure that demands growth in order to have revenue. The original document must be read for a complete description.

Where does a city get its money?

Taxes: A tax is a charge for public services and facilities. There need not be a direct relationship between the services and facilities used by an individual taxpayer and the tax paid.

Fees: Charges and Assessments A fee is a charge imposed on an individual for a service that the person chooses to receive.

Intergovernmental Revenue: Cities also receive revenue from other government agencies, principally the state and federal governments.

Intergovernmental Revenue: Cities also receive revenue from other government agencies, principally the state and federal governments.Other City Revenues: Other sources of revenue to cities include rents, concessions and royalties; investment earnings; revenue from the sale of property; proceeds from debt financing; revenues from licenses and permits; and fines and penalties. Each type of revenue has legal limitations on what may be charged and collected as well as how the money may be spent.

Putting Money in Its Proper Place

The law restricts many types of city revenues to certain uses. As explained above, a special tax is levied for a specific program. Some subventions are designated by law for specific activities. Fees are charged for specific services, and fee revenue can fund only those services and related expenses. To comply with these laws and standards, finance departments segregate revenues and expenditures into separate accounts or funds. The three most important types of city funds are:

- special revenue funds

- enterprise funds

- general fund

Major City Revenues

Sales and Use Tax: The sales tax an individual pays on a purchase is collected by the state Board of Equalization and includes a state sales tax, the locally levied Bradley-Burns sales tax and several other components. The sales tax is imposed on the total retail price of any tangible personal property. (State law provides a variety of exemptions to the sales and use tax, including resale, interstate sales, intangibles, food for home consumption, candy, bottled water, natural gas, electricity and water delivered through pipes, prescription medicines, agricultural feeds, seeds, fertilizers and sales to the federal government.)

Sales and Use Tax: The sales tax an individual pays on a purchase is collected by the state Board of Equalization and includes a state sales tax, the locally levied Bradley-Burns sales tax and several other components. The sales tax is imposed on the total retail price of any tangible personal property. (State law provides a variety of exemptions to the sales and use tax, including resale, interstate sales, intangibles, food for home consumption, candy, bottled water, natural gas, electricity and water delivered through pipes, prescription medicines, agricultural feeds, seeds, fertilizers and sales to the federal government.)  Property Tax: The property tax is an ad valorem (value-based) tax imposed on real property and tangible personal property. (State law provides a variety of exemptions to the property tax, including most government-owned property; nonprofit, educational, religious, hospital, charitable and cemetery properties; the first $7,000 of an owner-occupied home; business inventories; household furnishings and personal effects; timber; motor vehicles, freight and passenger vessels; and crops and orchards for the first four years).

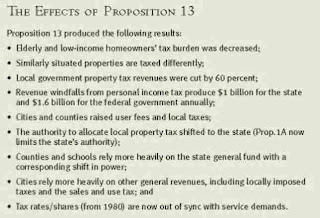

Property Tax: The property tax is an ad valorem (value-based) tax imposed on real property and tangible personal property. (State law provides a variety of exemptions to the property tax, including most government-owned property; nonprofit, educational, religious, hospital, charitable and cemetery properties; the first $7,000 of an owner-occupied home; business inventories; household furnishings and personal effects; timber; motor vehicles, freight and passenger vessels; and crops and orchards for the first four years).California Constitution Article XIIIA (Prop. 13) limits the property tax to a maximum 1 percent of assessed value, not including voter-approved rates to fund debt. The assessed value of property is capped at 1975–76 base year plus inflation — or 2 percent per year. Property that declines in value may be reassessed at the lower market value. Property is reassessed to current full value upon change in ownership (with certain exemptions). Property tax revenue is collected by counties and allocated according to state law among cities, counties, school districts and special districts.

Business License Tax (BLT): Most cities in California levy a business license tax. Tax rates are determined by each city, which collects the taxes. Business license taxes are most commonly based on gross receipts or levied at a flat rate but are sometimes based on the quantity of goods produced, number of employees, number of vehicles, square footage of the business or some combination of factors.

Transient Occupancy Tax (TOT): Like the business license tax, a TOT may be levied by a city under the police powers granted to cities in the state Constitution. More than 380 cities in California impose TOT on people staying for 30 days or less in a hotel, inn or other lodging facility. Rates range from 4 to 15 percent of the lodging cost.

Utility User Tax (UUT). More than 150 cities (collectively representing a majority of the state’s population) impose a utility user tax. UUT rates vary from 1 to 11 percent and are levied on the users of various utilities, which may include telephone, electric, gas, water and cable television. For cities that impose the UUT, it provides an average of 15 percent of general revenue and often as much as 22 percent.

Vehicle License Fee (VLF). The VLF is a tax imposed by the state on the ownership of a registered vehicle in place of taxing vehicles as personal property. Property Tax in Lieu of Vehicle License Fee Property tax revenue (including property tax in lieu of VLF) accounts for more than one-third of general revenue for the average full-service city.

Parcel Tax This is a special non-value based tax on property, generally based on either a flat per-parcel rate or a variable rate depending on the size, use or number of units on the parcel. Parcel taxes require two-thirds voter approval and are imposed for a variety of purposes, including police and fire services, parks, libraries and open space protection. Parcel taxes provide less than 1 percent of city revenues statewide.

Rents, Royalties and Concessions: Examples of revenues generated through the use of city property include royalties from natural resources taken from city property, the sale of advertising in city publications, payments from concessionaires operating on city property, facility rentals, entry charges, on- and off-street parking charges and even golf fees.

Franchises: Franchise fees are collected in lieu of rent for use of city streets from refuse collectors, cable television companies and utilities. Some franchise charges are limited by statute.

Fines, Forfeitures and Penalties: Cities receive a share of fines and bail forfeitures from misdemeanors and infractions committed within city boundaries. State law determines the distribution and use of state-imposed fines and forfeitures, but cities determine penalties for violations of their municipal codes.

Service Charges and Fees: Cities have authority to impose fees, charges and rates for services and facilities they provide, such as plan checking or recreation classes. Use of these revenues is limited to paying for the service for which the fees are collected, but may include overhead, capital improvements and debt service. City utilities and enterprises supported by service fees constitute a substantial portion of most city budgets. These include water, sewer, electricity and solid waste services. In some cities, a public or private agency other than the city provides and funds these services.

Where can we find these numbers in Encinitas?

The city council will be talking about the budget tomorrow and again in June. These financial reports need a vigilant public assessing what is being reported. Citizens may put in FOIA forms to ask for these figures cited above. We would like to be aware of the specifics for Encinitas.

If you know where to access the various revenue breakdowns described in the primer, please let us know at our email address. encinitasyouneedus@gmail.com